Financial Accounting Final

FINAL REPORTING REQUIREMENTS FOR DISSERTATION FIELDWORK AND POST PH.D. RESEARCH GRANTS

Upon conclusion of the research phase funded by the Wenner-Gren Foundation, the following reports must be submitted. It is not necessary to have completed the entire research project. Reports should be e-mailed as attachments to Programs Assistant, Mark Ropelewski at mropelewski@wennergren.org. The grantee will be notified when the grant is complete. If a notification of completion is not received, the grantee should contact the Foundation to check on the status. Please be sure to update all contact information (mailing address, phone and fax numbers, e-mail address, etc.) when the final reports are sent. Please note: all reports must be submitted in file formats compatible with Microsoft Word or Excel 2010. Reports should be prepared using an 11-point font and one-inch margins. If you have any questions regarding these reports, please contact the Foundation.

FOR DISSERTATION FIELDWORK AND POST PHD RESEARCH GRANTS:

1. FINAL REPORT, maximum 1500 words, or three pages, summarizing the research phase supported by Wenner-Gren and findings to date. Please discuss the way your research findings to date help answer your research question; also indicate the evidence you collected and the way it leads to your research findings. The final report may be single or double-spaced. Your name, address and grant number must appear on the first page.

2. ABSTRACT or summary of the final report for publication on the Foundation’s website, no more than 200 words, and should be written in a style that is clearly understandable to a nonspecialist. The Abstract should not be written in the first person and should summarize only the research undertaken during this grant.

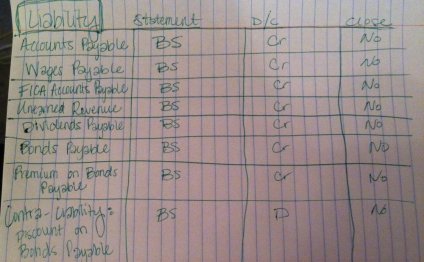

3. FINANCIAL ACCOUNTING of all funds provided by the Wenner-Gren Foundation. Please account only for funds received from Wenner-Gren. The format for the financial accounting should be similar to that used in the approved budget request, itemizing actual expenditures and showing how figures were calculated. Significant changes from original request should have been approved by the Foundation in advance. If prior approval was not obtained, changes must be fully explained at this time. Please note that the grantee may be required to reimburse the Foundation for unauthorized expenditures. In addition, unexpended grant funds must be returned to the Foundation upon completion of the project phase. Receipts should not be sent, but it is recommended that the grantee retain all receipts for personal financial records.

Equipment: If any item of equipment purchased with grant funds at an original cost in excess of $750 still has monetary value, the resale value must be returned to the Foundation; or, upon approval by the Foundation, such equipment may be donated to an educational or research institution preferably in the country where the research was carried out. Please include information regarding the disposition of equipment with the Financial Accounting and/or include a check or money order for resale value, if applicable. If equipment is donated, the Foundation must receive a letter from the institution acknowledging receipt of the equipment.

Institutional Accountings: Grantees who elected to have payment made and administered through their institutions are responsible for verifying that the accounting is accurate and that the categories and amounts conform to the original budget request. If the accounting is acceptable, the grantee should sign it to indicate his/her approval. If it is not, the grantee must prepare a separate accounting as described above.

FOR DISSERTATION FIELDWORK GRANTS ONLY:

4. SUPERVISOR’S FINAL EVALUATION: The supervisor must provide a one-page report evaluating the grantee’s research and progress towards degree. The supervisor can send a letter or use the evaluation form posted below. Please note: the supervisor must indicate they’ve reviewed and approved the financial accounting by either signing the accounting, approving it in their letter, or by using the online supervisor’s final evaluation form, noted above.

THESE REPORTS MUST BE SUBMITTED TO THE FOUNDATION UPON COMPLETION OF THE RESEARCH PHASE SUPPORTED BY WENNER-GREN. IF SUFFICIENT CAUSE FOR DELAY IS NOT DEMONSTRATED, THE GRANT WILL BE DESIGNATED “CLOSED-INCOMPLETE”, AND THE GRANTEE WILL BECOME INELIGIBLE FOR FURTHER SUPPORT FROM THE WENNER-GREN FOUNDATION.

new website https://goo-gl.ru/

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting Manual

This Financial Accounting Manual for Federal Reserve Banks (FAM) contains the accounting standards that should be followed…

Read MoreFinancial Accounting App

The Ten Best Accounting Apps for Small Business Owners Who HATE

Read More