Accounting Financial statements

The financial statements are prepared from the information in the trial balance. Return to this if you would like to brush up on this earlier step in the accounting cycle.

Purpose of Accounting Reports and the Financial Statements

Accounting reports come in various formats and all provide different information. However, they all have one thing in common: they give useful information about a business (or about an aspect of the business) to the reader.

The specific stated purpose of the financial statements is to show the reader the financial position, financial performance and cash flows of a business.

The specific stated purpose of the financial statements is to show the reader the financial position, financial performance and cash flows of a business.

The financial position of the business is shown in the balance sheet, the financial performance of the business is shown in the income statement (also known as the profit and loss report), and the business cash flows are shown in the cash flow statement. This will become clearer as you go through each of these reports that comprise the financial statements.

Users of Financial Statements

But here's a question - who are the readers or users of the financial statements? Who are these reports prepared for?

Well, the financial statements are like the business scorecard - they show if the business is doing well or not.

The people who want to see the financial statements are the people that are interested in this business scorecard - the guys who want to know how well the business is doing and details about the business income, expenses, assets, etc.

These people, in rough order of importance, typically include:

1) Business owners - They have the most direct interest in how well the business is doing. The better the business performs, the more money they make.

1) Business owners - They have the most direct interest in how well the business is doing. The better the business performs, the more money they make.

2) Business executives - Managers (people employed by the owners to run the business) will get fired if the business performs poorly, or get bonuses if it performs well!

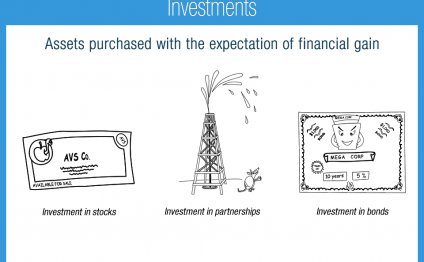

3) Investors - Investors are only going to invest in businesses with good scorecards.

4) The bank - They are interested in the financial statements (the business scorecard) of businesses they have a relationship with. For example, they may want to look at the financial statements to see how risky it would be to loan money to the business.

5) The government and tax authorities - They want to know that the business is fulfilling their legal duties, and in particular, that they are paying enough tax! The financial statements give a good idea of how much tax the business should be paying over.

6) Suppliers - Suppliers want to get paid by the business they are supplying goods to! So they may want to check the financial statements of the business before they even begin to make any agreements to trade with them.

6) Suppliers - Suppliers want to get paid by the business they are supplying goods to! So they may want to check the financial statements of the business before they even begin to make any agreements to trade with them.

7) Employees - Though this is not often the case, an employee may want to know how well the business is doing so he or she can plan for the future. For example, if the business looks like it might fall apart soon, the employee would probably want to start looking for another job!

Note that the drawing up of financial statements is a compulsory (legal) obligation for public companies - companies that are listed on a public stock exchange. Also, after they are finalized, their financial statements have to be audited (checked by an external auditor). For these companies the financial statements must be prepared once a year, but the company executives may also want them prepared more often for internal and other uses. For other types of corporations such as private companies, it is also customary to prepare the financial statements annually.

Alright, now that we know what the financial statements are, let's take a look at the first of its reports, the income statement (also known as the profit and loss report).

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Basic Accounting Financial statements

Marilyn points out that an income statement will show how profitable Direct Delivery has been during the time interval shown…

Read MoreAccounting Financial Statement

The income statement is a key financial statement which reports on a company s profitability during a relatively short period…

Read More