Financial Freedom account

Investment Performance Is Not Guaranteed.

Prospectuses for variable annuities issued by a MetLife insurance company, and for the investment portfolios offered thereunder, are available from your financial professional. The contract prospectus contains information about the contract’s features, risks, charges and expenses. Investors should consider the investment objectives, risks, charges and expenses of the investment company carefully before investing. The investment objectives, risks and policies of the investment options, as well as other information about the investment options, are described in their respective prospectuses. Please read the prospectuses and consider this information carefully before investing. Product availability and features may vary by state. Please refer to the contract prospectus for more complete details regarding the living and death benefits.

Variable annuities are long-term investments designed for retirement purposes. MetLife variable annuity products have limitations, exclusions, charges, termination provisions and terms for keeping them in force. There is no guarantee that any of the variable investment options in this product will meet their stated goals or objectives. The account value is subject to market fluctuations and investment risk so that, when withdrawn or annuitized, it may be worth more or less than its original value, even when an optional protection benefit is elected. All product guarantees, including optional benefits, are subject to the claims-paying ability and financial strength of the issuing insurance company. Please contact your financial professional for complete details.

MetLife Shield Level Selector is a long-term investment designed for retirement purposes and has limitations, exclusions, charges, termination provisions and terms for keeping it in force. There is a risk of substantial loss of principal for losses beyond the Shield Rate your clients select, because your clients agree to absorb all losses that exceed their chosen Shield Rate. Please refer to “Risk Factors” in the contract prospectus for more details. All contract guarantees, including the optional death benefit and annuity payout rates, are subject to the claims-paying ability and financial strength of the issuing insurance company.

Annuity withdrawals of taxable amounts are subject to ordinary income tax and if made before age 59½, may be subject to a 10% Federal income tax penalty. Withdrawals will reduce the living and death benefits and account value. Withdrawals may be subject to withdrawal charges. Withdrawals prior to age 59½ from a 403(b) annuity or prior to age 70½ from a 457(b) plan are generally restricted. Withdrawals of taxable amounts are subject to ordinary income tax and if taken before age 59½ (where permitted) may be subject to a 10% Federal income tax penalty. However, a distribution from a 457(b) plan before age 59½ (where permitted) is not subject to the 10% federal income tax penalty, unless the distribution is from a governmental 457(b) plan and is attributable to rollover amounts accepted from another type of eligible retirement plan (such as a 403(b) contract or IRA). Distributions of taxable amounts from a non-qualified annuity may also be subject to the 3.8% Unearned Income Medicare Contribution Tax on Net Investment Income if your modified adjusted gross income exceeds the applicable threshold amount.

Variable annuities other than Enhanced Preference Plus Account, Financial Freedom Account, Preference Plus Account, Preference Premier, Preference Plus Select, Preference Plus Income Advantage, MetLife Financial Freedom Select, and MetLife Shield Level Selector Single Premium Deferred Annuity are issued by MetLife Insurance Company USA; Charlotte, NC 28277 and in New York, only by First MetLife Investors Insurance Company; New York, NY 10166. The Enhanced Preference Plus Account, Financial Freedom Account, Preference Plus Account, Preference Premier, Preference Plus Select, Preference Plus Income Advantage, MetLife Financial Freedom Select and Vestmet variable annuities are issued by Metropolitan Life Insurance Company; New York, NY 10166; and are offered through MetLife Securities, Inc. 1095 Avenue of the Americas, New York, New York 10036. American Forerunner Series are issued by New England Life Insurance Company, Boston, MA 02116. All products are distributed by MetLife Investors Distribution Company (member FINRA). All are MetLife companies.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

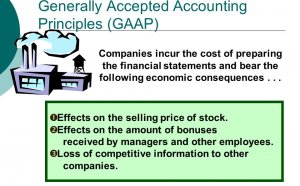

Principles of Financial Accounting McGraw Hill

Principles of Financial Accouting John J. Wild, University of Wisconsin-Madison Ken W. Shaw, University of Missouri-Columbia…

Read MoreRelevance in Financial Accounting

In accounting, the term relevance means it will make a difference to a decision maker. For example, in the decision to replace…

Read More