Financial Accounting and Reporting CPA Exam questions

The financial accounting and reporting (FAR) test of the CPA exam covers the nuts and bolts of working as an accountant. One focus of this test is the typical transactions that an accountant posts each month and year. The FAR test also goes over accounting principles.

- Sun Co. is a wholly owned subsidiary of Star Co. Both companies have separate general ledgers and prepare separate financial statements. Sun requires standalone financial statements. Which of the following statements is correct?

A. Consolidated financial statements should be prepared for both Star and Sun.

B. Consolidated financial statements should be prepared only by Star and not by Sun.

C. After consolidation, the accounts of both Star and Sun should be changed to reflect the consolidated totals for future ease in reporting.

D. After consolidation, the accounts of both Star and Sun should be combined into one general-ledger accounting system for future ease in reporting.

Answer: B. Star owns Sun; therefore, consolidated financial statements should be prepared for Star but not Sun.

- The premium on a 3-year insurance policy expiring on December 31, Year 3, was paid in total on January 1, Year 1.

Assuming that the original payment was initially debited to an expense account and that appropriate adjusting entries have been recorded on December 31, Year 1 and Year 2, the balance in the prepaid asset account on December 31, Year 2, would be

A. Zero.

B. Lower than the balance on December 31, Year 3.

C. The same as the original payment.

D. The same as it would have been if the original payment had been initially debited to a prepaid asset account.

Answer: D. This answer is correct because under either method, the balance in the prepaid asset account on December 31, Year 2 (12/31/Y2), should be the unexpired portion of the policy. On 12/31/Y1, an adjusting entry would be made by debiting Prepaid insurance and crediting Insurance expense for two-thirds of the original payment (the unexpired portion of the policy).

This would result in one-third of the payment being expensed. This entry would then be reversed on 1/1/Y2. At the end of Year 2, an adjusting entry would again be made by debiting Prepaid insurance and crediting Insurance expense for one-third of the original payment (the unexpired portion of the policy).

Because the reversing entry will not be made until 1/1/Y3, the prepaid asset account balance would be the same on 12/31/Y2 for this method as it would have been had the payment originally been debited to Prepaid insurance on 1/1/Y1.

YOU MIGHT ALSO LIKE

![[PDF Download] CPA Financial Accounting & Reporting Exam](/img/video/pdf_download_cpa_financial_accounting_reporting.jpg)

![[PDF] CPA Financial Accounting & Reporting Exam Flashcard](/img/video/pdf_cpa_financial_accounting_reporting_exam.jpg)

Share this Post

Related posts

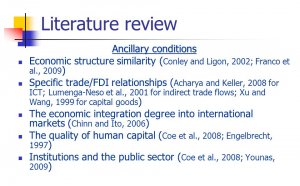

International Journal of Managerial and Financial Accounting

Editor in Chief: Dr. Matteo Rossi ISSN online: 1753-6723 ISSN print: 1753-6715 4 issues per year Subscription price IJMFA…

Read MoreManagerial and Financial Accounting

Managerial finance is the branch of finance that concerns itself with the managerial significance of finance techniques…

Read More