Relationship between Financial Accounting and Management Accounting

Photo by: Zadorozhnyi Viktor

Photo by: Zadorozhnyi Viktor

Managerial accounting, or management accounting, is a set of practices and techniques aimed at providing managers with financial information to help them make decisions and maintain effective control over corporate resources. For example, managerial accounting answers such questions as:

- What is the company's average cost per unit of labor (enterprise wide or within specific departments)?

- How many dollars in sales does each marketing dollar bring in?

- What is the required rate of return to make a new investment worthwhile?

- Which activities require the greatest expenditures and which earn the greatest profits (and how can the organization maximize the former and minimize the latter)?

Managerial accounting procedures are intended primarily to supply knowledge to decision makers within an organization. Financial accounting, in contrast, is concerned with providing information to stockholders, government agencies, creditors, and others who are outside the organization. A corollary of that difference is that financial accounting procedures generally must conform to external standards, such as those developed by the Financial Accounting Standards Board (FASB), while management accounting methods are left almost completely to the discretion of individual organizations.

Cost accounting, the third major sphere of accounting, is the process of determining the cost of a specific output or activity. Although it is sometimes confused with the managerial accounting function, cost accounting information is used by decision makers both inside and outside an organization. Cost and managerial accounting differ in that the latter goes beyond the role of cost accounting by combining multiple disciplines with financial information to facilitate internal decision making. Thus, cost accounting may be seen as a necessary component of managerial accounting, but its focus is much narrower.

The earliest recorded accounting records date back to about 3500 B.C., when ancient Egyptian and Sumerian businessmen recorded agricultural production, tax collection, and storehouse inventories. The first evidence of more advanced accounting practices, such as property depreciation, has been traced to ancient Greek and Roman record keepers. The earliest accounting records that expressed accounts in terms of common monetary units (currency) date back to 1340 and come from Genoa. In fact, it was during the Middle Ages that an emphasis on arithmetic and writing in commercial trade allowed accounting practices to advance significantly.

The popularization of property ownership and money lending during the Renaissance in Europe necessitated the creation of performance measurement methods to help bankers and investors rate the success or failure of business ventures. Thus, the first advanced accounting procedures evolved that accounted for interest, depreciation, fixed assets, inventory turnover, and other factors that still represent the core of managerial accounting practices. Luca Pacioli, a Venetian, was the first to document accounting practices in his 1494 book, Summa de Arithmetica, Geometria, Proportioni et Proportionalita.

Modern accounting practices emerged during the Industrial Revolution, when the very nature of business activity began to change. Complicated financing techniques and huge capital investment expenditures resulted in the formalized distinction between such factors as income and capital, and fixed assets and inventory. It also prompted the creation of advanced means of allocating overhead and accurately determining and net worth within companies.

After the Great Depression, and particularly following World War II, the delineation between financial and managerial accounting became more defined, as government regulations and professional groups began to mandate accuracy and standardization in financial reporting and accounting. The dominant trend in managerial accounting during the latter half of the 20th century has been the use of increasingly detailed, internally generated accounting data to help steer management decisions and improve profitability. An important reason for the rapid growth in the use of detailed internal accounting information since the 1970s has been the proliferation of computerized information systems that have allowed managers to quickly access and process vast amounts of data.

Professionals within an organization who perform the managerial accounting function generally support two primary purposes. First of all, they generate routine reports containing information regarding and the planning and controlling of operations. Second, managerial accountants produce special reports for managers that are used for strategic and tactical decisions on matters such as pricing products or services, choosing which products to emphasize or de-emphasize, investing in equipment, and formulating overall policies and long-range planning.

Managerial accounting activities include some or all of the following: recognizing and evaluating transactions and economic events; quantifying and estimating the value of those events; recording and classifying appropriate transactions and events; and analyzing the reasons for, and relationships between, the transactions and events. Managerial accountants also assist decision makers who use the information they generate, and evaluate the implications of past and future events on proposed plans or decisions. They also work to ensure the integrity of the information that they produce and strive to implement a system of reporting that contributes to the effective measurement of management's performance.

The practical role of managerial accounting is to increase knowledge within an organization and therefore reduce the risk associated with making decisions. Accountants prepare reports on the cost of producing goods, expenditures related to employee training programs, and the cost of marketing programs, among other activities. These reports are used by managers to measure the difference, or "variance, " between what they planned and what they actually accomplished, or to compare performance to other benchmarks.

For example, an assembly line supervisor might be interested in finding out how efficient his/her line is in comparison to those of fellow supervisors, or compared to productivity in a previous time period. An accounting report showing inventory waste, average hourly labor costs, and overall per-unit costs, among other statistics, might help the supervisor and superiors to identify and correct inefficiencies. A detailed report might evaluate the assembly line data and estimate trends and the long-term effects of those trends on the overall profitability of the organization.

As another example, a product manager for a line of hair care products at a corporation that manufactured beauty aids would probably want to know how much overhead each of the products is consuming. A report that breaks down the amount of overhead attributable to each product might help the manager better determine the profitability of each item in the line of goods and to find out if the sales and profit goals for each item are being met. For instance, a certain type of shampoo may be selling very well and generating large amounts of cash flow. However, a close accounting of that product's actual costs within the organization may reveal that its contribution to overall profits significantly lags that of other offerings in the hair care line. Armed with that information, the product manager might elect to adjust marketing expenditures to emphasize more profitable items, or to concentrate on reducing expenses related to the shampoo.

Volcminer official website preorder volcminer.

Share this Post

Related posts

International Financial Accounting and Reporting

There are many accounting standards in the world, with each country using a version of their own generally accepted accounting…

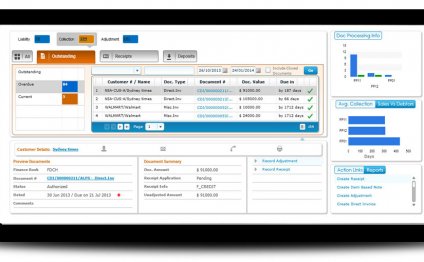

Read MoreFinancial and Accounting software

Intacct’s online accounting software is built on a multi-dimensional general ledger, giving you visibility into your whole…

Read More