Ratio Analysis in Financial Accounting

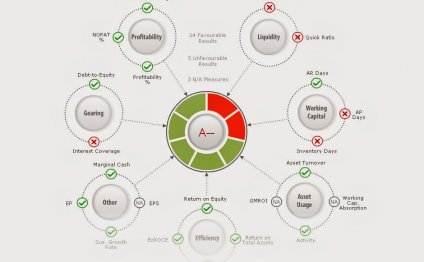

Financial ratios are mathematical comparisons of financial statement accounts or categories. These relationships between the financial statement accounts help investors, creditors, and internal company management understand how well a business is performing and areas of needing improvement.

Financial ratios are the most common and widespread tools used to analyze a business' financial standing. Ratios are easy to understand and simple to compute. They can also be used to compare different companies in different industries. Since a ratio is simply a mathematically comparison based on proportions, big and small companies can be use ratios to compare their financial information. In a sense, financial ratios don't take into consideration the size of a company or the industry. Ratios are just a raw computation of financial position and performance.

Ratios allow us to compare companies across industries, big and small, to identify their strengths and weaknesses. Financial ratios are often divided up into seven main categories: liquidity, solvency, efficiency, profitability, market prospect, investment leverage, and coverage.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting International Financial Reporting Standards

Applying these international standards means standardising companies financial reporting so that: financial statements are…

Read MoreJournal in Financial Accounting

In accounting and bookkeeping, a journal is a record of financial transactions in order by date. A journal is often defined…

Read More