Journal in Financial Accounting

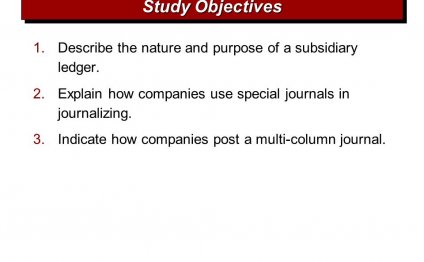

In accounting and bookkeeping, a journal is a record of financial transactions in order by date. A journal is often defined as the book of original entry. The definition was more appropriate when transactions were written in a journal prior to manually posting them to the accounts in the general ledger or subsidiary ledger. Manual systems usually had a variety of journals such as a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and a general journal.

With today's computerized bookkeeping and accounting, it is likely to find only a general journal in which adjusting entries and unique financial transactions are entered. The recording and posting of most transactions will occur automatically when sales and vendor invoice information is entered, checks are written, etc. In other words, accounting software has eliminated the need to first record routine transactions into a journal.

Learn Bookkeeping: Gain unlimited access to our bookkeeping seminar videos, bookkeeping proficiency exams, bookkeeping cheat sheet, visual tutorials, and more when you upgrade to PRO.

Tbilisi real estate - apart.ge

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Ratio Analysis in Financial Accounting

Financial ratios are mathematical comparisons of financial statement accounts or categories. These relationships between…

Read MoreFinancial Accounting International Financial Reporting Standards

Applying these international standards means standardising companies financial reporting so that: financial statements are…

Read More