Summary of Financial Accounting

Financial summaries can reveal the successes and failures of a business. The summaries gather data from accounting records to draw conclusions about profit, loss, and cash flow, and to evaluate a company's overall financial health. There are specifics and standards to creating a financial summary, and there are certain types of summaries that are asked for during audits and company marketing opportunities.

Definition

A financial or accounting summary sums up a company's financial activity for a specific period of time. Summaries can by assembled for a week, month or quarter, or for longer periods, such as a year, three years, five years or 10 years. Summarizing business transactions can help a company make future plans regarding growth, sales and profit by looking back at what was achieved previously. Financial summaries are created as financial statements. The formats for reporting the various statements, along with the way in which the financial data is gathered, follow generally accepted accounting principles, known as GAAP.

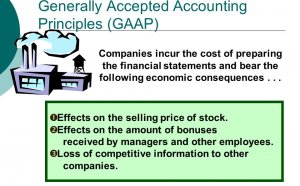

GAAP

GAAP is a set of standards used by CPAs, corporations and small businesses that outline how to record and summarize business transactions. When companies follow the same accounting principles, financial summaries can be read with greater clarity and understanding, and a clear comparison can be made between companies that sell or produce the same products or services. The Financial Accounting Standards Board, a nonprofit board created by the accounting profession, manages the GAAP standards.

Related Reading: What Are Healthy Signs in the Cash Flow Statement?

Types

There are three prominently used summaries that businesses depend upon to tell their financial story. Those are the statement of income, the statement of cash flow, and the balance sheet. Each statement gathers its data from certain accounts used in accounting practices. The income statement is derived from the profit and loss accounts, and reveals how the company is doing in terms of costs versus sales. The cash flow statement uses information regarding assets and liabilities, and is focused on the liquidity or available cash the company has on hand. It derives some of its data from the income statement, but excludes transactions that do not affect cash flow, such as depreciation or bad debt write-offs. The balance sheet summarizes data from the assets, liabilities and owner equity accounts.

Uses

Accounting summaries are windows into the financial health of a business and can be used for many reasons. Audits required by government or industry often begin with an examination of a company's financial summaries. A publicly traded business may release financial summaries to encourage people to invest in its stocks. Managers and executives use the summaries to judge whether goals and expectations are being met, and to assess and plan future goals and changes to the business. Creditors often reference a company's financial summaries if the company is seeking to get a loan, or to get existing loan requirements reorganized.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Principles of Financial Accounting McGraw Hill

Principles of Financial Accouting John J. Wild, University of Wisconsin-Madison Ken W. Shaw, University of Missouri-Columbia…

Read MoreBasic Principles of Financial Accounting

There are general rules and concepts that govern the field of accounting. These general rules–referred to as basic accounting…

Read More