Principles of Financial Accounting

If you are doing business, then you need to know the basic accounting principles by heart. Accounting is the language of business. Thus, every entrepreneur, executive, manager or student needs to understand at least the basic accounting principles.

BASIC ACCOUNTING

Over time your business will enter into transactions with other businesses, individuals and the tax authority. The business transactions need to be counted (aka accounting

) and categorized accordingly, so you can understand what has driven the change in your financial position.FINANCIAL STATEMENTS

The financial statements show you the categorized transactions that happened at a point in time. A good example for learning purposes are the financial statements of Hugo Boss or Facebook. Let me walk you through the three financial statements.

1. Income statement

Let’s assume over the current year you had the following business transactions that could be categorized into income and expenses.

Income Sales; you sold different types of products and services to B2C and B2B customers and can expect them to pay a known price Tax income; your business was not running very well and your earnings before taxes is negative. The tax authority will give you a type of tax income so you pay less income tax in future years (see tax loss carry forward). Don’t be afraid, this is one of the more advanced income types. Expense Purchases; you used and/or were delivered some goods and services from other businesses Employees; you hired a bunch of people who worked for you Depreciation; the price of a good used for multiple periods (e.g. machinery, building) is distributed over the periods Interests; you financed your business with bank debt and need to pay interest Tax expenses; when your earnings before taxes is positive (yiehaa!!! you earned some money ), then you will need to pay income taxes to tax authoritiesLet’s have a look at an examplary income statement. This will help you get familiar with the different types of income and expenses that are part of the basic accounting.

2. Balance sheet

The balance sheet collects everything you own (=assets) and owe (=liabilities) at a specific point in time resulting from past transactions.

A common categorization of assets is as follows:

Fixed assets; this is the net value remaining for goods that are used over multiple periods Trade receivables; this is the amount your customers owe you and includes the value added tax VAT asset; this is the value added tax that was part of the goods and services you purchased, the tax authority owes you this money Inventory; this is the net remaining value of raw materials, work in progress, finished products and trading goods Cash; this is how much cash you have in the bank and on handThe liabilities can be classified in the following way:

Trade payables; this is the gross amount outstanding that you owe your suppliers Provisions; this is the amount you owe suppliers from which you did not receive invoices yet. Provisions are uncertain in timing and amount. VAT liability; this amount is associated with the sales you generated. You owe this amount to the tax authorities. Debt; you owe this amount to your banks as they provided you with debt Equity; this amount is owed to your equity investors and basically consists of capital and retained earningsGenerally speaking, the income from the income statement increases the associated asset. This means that more income will increase the amount you own (= others owe to you). Similarly the expenses from the income statement increase the liabilities. This means that expenses will increase the amount you owe to others.

Let’s have a look at an example of a balance sheet, so you get a better grasp of the basic accounting principles.

IMPORTANT: The balance always needs to balance, hence the name balance sheet 😉

At some point you would like your assets to be converted into cash (e.g. your customers pay their bills) or you will have to pay your suppliers. This we will discuss in the next step – the cash flow statement.

3. Cash flow statement

The cash flow statement explains the change in cash from one period to the next period. The cash flow statement consists of the following parts:

OPERATING CASH FLOW; The operating cash flow shows the cash in-flow and out-flow related to your operative business. There are two ways to calculate the operating cash flow: Indirect method; The indirect method starts with the net income and adds the non-cash charges from the income statement. Then you will add the change in each balance sheet account from last period until this month except for the balance sheet items cash, fixed assets, debt and equity. At last you add net income, income statement adjustments and balance sheet adjustments. Direct method; The direct method categorizes all cash payments related to the assets and liabilities on the balance sheet into cash received from customers, cash paid to suppliers, cash paid to employees, and cash paid to tax authorities. INVESTING CASH FLOW; The investing cash flow shows how much cash you invested into fixed assets. You get the capital expenditures (short: capex) by adding the depreciation to the change in fixed assets found on the balance sheet. FINANCING CASH FLOW; The financing cash flow explains how much cash was received from and paid to investors like debt and equity investors.The sum of all three cashflows is the change in cash from last period until today.

Please study the following example for further understaning the cash flow statement, so become better at understanding the basic accounting principles.

RELATIONSHIP BETWEEN FINANCIAL STATEMENTS

The three financial statements are heavily interconnected as you have seen how the assets and liabilities on the balance sheet will increase based on the incomes and expenses from the income statement and decrease based on the cash flows from the cash flow statement.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Principles of Financial Accounting McGraw Hill

Principles of Financial Accouting John J. Wild, University of Wisconsin-Madison Ken W. Shaw, University of Missouri-Columbia…

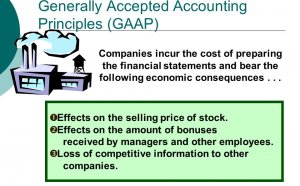

Read MoreBasic Principles of Financial Accounting

There are general rules and concepts that govern the field of accounting. These general rules–referred to as basic accounting…

Read More