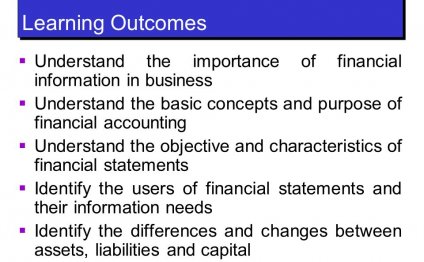

Importance of Financial Accounting in Business

Rigorous accounting requires time and effort, but your business won't remain viable without it.

Rigorous accounting requires time and effort, but your business won't remain viable without it.

Jupiterimages/Comstock/Getty Images

Accounting and finance play an existential role in the management of any business. In the words of John Nessel, president of the Restaurant Resource Group, "If you can't count it, you can't manage it." He means that companies operate on money, and if you don't control that money, you don't control your business. By properly accounting for your company's income and expenses, you can manage the flow of money and thereby direct the course of your business.

Obeying the Law

Good accounting practices have a practical advantage: They keep your company in compliance with the law. Without good accounting you could violate any number of laws, such as not paying the right amount of taxes. The sloppiness of poor accounting can also cause you to overlook many minor details that collectively keep a business on the level, like carrying out facility improvements to comply with safety laws. Additionally, if you ever find yourself under legal scrutiny - and many businesses eventually do - having poor financial records can create a lot of unnecessary trouble.

Creating Budgets

By understanding the flow of money through your business with proper accounting practices, you can begin budgeting. In budgeting, you anticipate revenues and use that knowledge to make decisions about how to maintain and grow your business. Budgets are the culmination of good financial record keeping. You can think of them as blueprints in that they take a lot of hard work and information to create but ultimately allow you to build your business to greater stability and success.

Related Reading: Role of Accounting in a Start Up Business

Analyzing Performance

It's hard to improve upon a business if you don't have a means to understand the past and learn from it. Good accounting is that means. By reviewing your company's financial records, you can see not only where the money went but what good it did in the long run. In this way you can begin to assess how much value your company's various expenses contribute to the overall operation. With that kind of information you can make informed decisions about which operations to downsize and which to grow. You will also be able to identify new areas where a little expense up front can pay big dividends later.

Developing Strategy

The goal of most companies is to make a profit, but the road to get there is one you have to build yourself. Financial data from within your own company comprises one of the chief tools you have in understanding the economic landscape of the market you're operating in. If your customers are buying more widgets and fewer gizmos, that's something your records can tell you. And if your records tell you you're not getting good enough returns from an outside advertising firm, you can make the decision to bring advertising in house, hiring a whole new department and fundamentally reshaping your business. Good strategy will take your business to richer destinations, but good strategy requires good information.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Ratio Analysis in Financial Accounting

Financial ratios are mathematical comparisons of financial statement accounts or categories. These relationships between…

Read MoreFinancial Accounting International Financial Reporting Standards

Applying these international standards means standardising companies financial reporting so that: financial statements are…

Read More