Financial Accounting Case study

Accounts are records of financial transactions. Information that is used in accounts is initially entered into books of prime entry, which may simply be paper or computer records. This helps with financial planning. From there the information will be entered into a double entry system in a book (or computer programme) called the ledger. Each account is kept on a separate page in the ledger, and every account has two sides - a debit and a credit side. Information will then be extracted so that it can be presented in a financial report.

The accounting equation. An essential component of accounting is what is referred to as the accounting equation, which in a nutshell means that the assets of the organisation (what it owns or is owed by others) is equal to the liabilities of the organisation (what it owes).

In this country (and internationally) there are a variety of accounting conventions and standards which must be adhered to.

In preparing final accounts there are a number of key accounting concepts which you need to be familiar with:

1. The going concern concept: an assumption that the business will continue to trade into the foreseeable future.

2. The consistency concept: that the same principles for constructing accounts will be maintained from one set of accounts to the next.

3. The concept of prudence: that in valuing a transaction, a conservative approach will be used, i.e. not to value at highest possible estimate.

4. The accruals concept: that revenues and costs are recorded when they occur rather than when the cash is received or paid.

5. The materiality concept: that financial transactions should be shown separately if by lumping them together with other transactions the user of the accounts might be misled.

If you examine the financial statements of well known UK public limited companies such as Cadbury Schweppes, etc, you will notice that there is consistency in the way the accounts are presented from one year to the next, enabling you to easily compare one year's figures with another. These figures will be presented in a prudent way so as not to mislead the reader, e.g. by not underestimating costs or falsely inflating revenues.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting Careers

As a financial accountant, you may choose to work in public accounting (doing jobs for multiple business clients) or private…

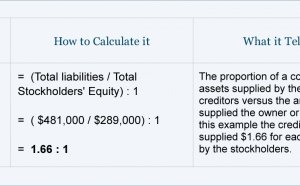

Read MoreFinancial Accounting ratios

Accounting ratios (also known as financial ratios) are considered to be part of financial statement analysis. Accounting…

Read More