Financial Accounting ratios

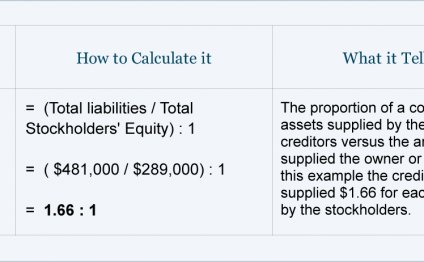

Accounting ratios (also known as financial ratios) are considered to be part of financial statement analysis. Accounting ratios usually relate one financial statement amount to another. For example, the inventory turnover ratio divides a company's cost of goods sold for a recent year by the cost of its inventory on hand during that year.

Accounting ratios (also known as financial ratios) are considered to be part of financial statement analysis. Accounting ratios usually relate one financial statement amount to another. For example, the inventory turnover ratio divides a company's cost of goods sold for a recent year by the cost of its inventory on hand during that year.

For a company with current assets of $300, 000 and current liabilities of $150, 000 its current ratio is $300, 000 to $150, 000, or 2 to 1, or 2:1. This ratio of 2:1 can then be compared to other companies in its industry regardless of size or it can be compared to the company's ratio from an earlier year.

Other examples of accounting ratios include:

To assist you in computing and understanding accounting ratios, we developed 24 forms that are available as part of AccountingCoach PRO.Studies show that exam questions are a great way to learn and retain important information. Gain access to our 1, 700 accounting exam questions (and answers) when you upgrade to PRO.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting entries

An accounting journal entry is the method used to enter an accounting transaction into the accounting records of a business…

Read MoreFinancial Accounting Careers

As a financial accountant, you may choose to work in public accounting (doing jobs for multiple business clients) or private…

Read More