Financial Accounting entries

An accounting journal entry is the method used to enter an accounting transaction into the accounting records of a business. The accounting records are aggregated into the general ledger, or the journal entries may be recorded in a variety of sub-ledgers, which are later rolled up into the general ledger. This information is then used to construct financial statements as of the end of a reporting period.

There must be a minimum of two line items in a journal entry, though there is no upper limit to the number of line items that can be included. A two-line journal entry is known as a simple journal entry, while one containing more line items is called a compound journal entry. A company may use a great many journal entries in just a single accounting period, so it is better to use a larger number of simple journal entries than a smaller number of compound journal entries, in order to clarify why the entries are being made. This is useful when journal entries are being researched at a later date, and especially when they are being reviewed by auditors.

Whenever you create an accounting transaction, at least two accounts are always impacted, with a debit entry being recorded against one account and a credit entry against the other account.

The totals of the debits and credits for any transaction must always equal each other, so that an accounting transaction is always said to be "in balance." If a transaction were not in balance, then it would not be possible to create financial statements. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy.

In a smaller accounting environment, the bookkeeper may record journal entries. In a larger company, a general ledger accountant is typically responsible for recording journal entries, thereby providing some control over the manner in which journal entries are recorded.

Format of the Journal Entry

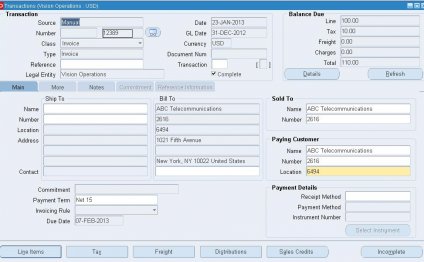

At a minimum, an accounting journal entry should include the following:

- The accounts into which the debits and credits are to be recorded

- The date of the entry

- The accounting period in which the journal entry should be recorded

- The name of the person recording the entry

- Any managerial authorization(s)

- A unique number to identify the journal entry

- Whether the entry is a one-time entry, a recurring entry, or a reversing entry.

- It may be necessary to attach extensive documentation to the journal entry, to prove why it is being recorded; at a minimum, provide a brief description of the journal entry.

Special Types of Accounting Journal Entries

A reversing journal entry is one that is either reversed manually in the following accounting period, or which is automatically reversed by the accounting software in the following accounting period.

A recurring journal entry is one that repeats in every successive accounting period, until a termination date is reached. This can be done manually, or can be set up to run automatically in an accounting software system.

get jetx play

YOU MIGHT ALSO LIKE

Share this Post

Related posts

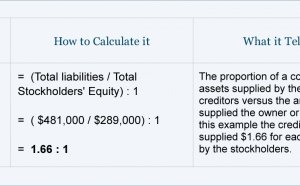

Financial Accounting ratios

Accounting ratios (also known as financial ratios) are considered to be part of financial statement analysis. Accounting…

Read MoreFinancial Accounting Programs

The curriculum comprises 4 required courses and 12 semester units of electives for a total of 24 semester units (360 hours…

Read More