Financial Accounting Tutorials

Students looking for free online accountancy training won't be able to earn college credit. Many of these free online resources are offered through OpenCourseWare programs. Students can complete these tutorials and courses on their own time.

AccountingCoach

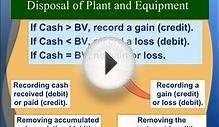

This website offers free readings, lesson samples, questions and answers, quizzes and crosswords. Forms, templates and seminar videos are only available for members with a paid subscription. Free lessons in Financial Accounting cover accounting basics, cash flow statements, financial ratios, payroll accounting, stockholder's equity, bookkeeping and depreciation. Under Managerial/Cost Accounting, lessons are available in improving profits, break-even point, manufacturing overhead, activity-based costing, standard costing, non-manufacturing overhead and business investments.

BizFilings

Lessons offered on this website feature readings, examples, diagrams and tips. The Accounting System and Accounting Basics lesson covers the fundamentals of accounting, such as recording transactions, balancing financials and putting together financial statements. Students are presented with definitions of common accounting terms. The Accounting for Tax Purposes lesson provides students with tips for preventing future federal tax audits and tracking business-related expenditures.

Massachusetts Institute of Technology

Students participating in these courses won't have access to required readings. The Financial Accounting course covers accrual accounting principles, annual reports, financial ratios, revenue recognition, long-lived assets, cash flow and marketable securities; lecture notes and accounting recitations are available as PDFs. The Introduction to Financial and Managerial Accounting course offers access to exams, assignments and lecture notes; students can learn about indirect allocation of costs, long-term debt, balance sheets, current liabilities, cost of goods sold and depreciation. The Management Accounting and Control class provides students with lecture notes and final exam guidelines. Topics include the nature of costs, cost allocation, standard costs, organizational economics, absorption cost systems, performance measurement and balanced scorecards.

New Jersey Institute of Technology

This course features video recordings of course lectures. Topics covered during these lectures include activities management, financial reports, product-cost analysis, statement of cash flows, break-even analysis, cost concepts and financial transaction recording.

The Open University

Content is offered by this website via reading materials and assignments. The Influences on Accounting Regulation course is recommended for master's-level students. Topics covered include stewardship, accounting rules, means of regulation, taxation, financial reporting objectives and national economics. Introduction to the Context of Accounting is an advanced course, and students may learn about accounting information systems, accountant roles and accounting firm objectives.

Simplestudies

This website's tutorials are offered through readings, diagrams and charts. While some tutorials are free, others are only available through a subscription. Free Financial Accounting tutorials include accounting basics, double-entry accounting systems, accounting for inventories, accounting in merchandising companies and accounting for accruals. Those interested in Managerial Accounting can access free tutorials in manufacturing and non-manufacturing costs, accounting cost behavior and accounting cost-volume-profit analysis.

University of Alaska - Anchorage

This resource from 2003 includes PowerPoint presentations, optional homework assignments and practice exams. The Principles of Financial Accounting course covers accounting information for business decisions, financial statements, inventory analysis, current liabilities and accounting information systems.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

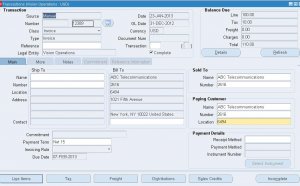

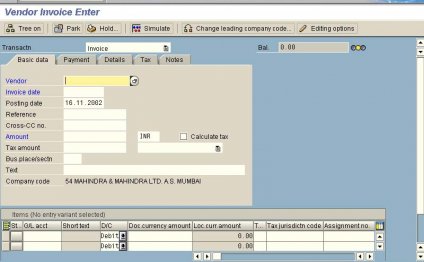

Financial Accounting entries

An accounting journal entry is the method used to enter an accounting transaction into the accounting records of a business…

Read MoreFinancial Accounting Programs

The curriculum comprises 4 required courses and 12 semester units of electives for a total of 24 semester units (360 hours…

Read More