Financial Accounting a Managerial perspective

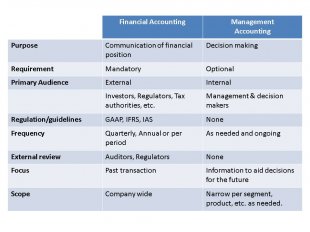

We get asked by students about the difference between financial accounting and managerial accounting. The average business school student will be exposed to both financial accounting and managerial accounting concepts during their program. Often both financial accounting and managerial accounting may be taught in the same course and so many students are unclear about the difference between financial accounting and managerial accounting. Financial accounting and managerial accounting are definitely closely related and mix well but there is clearly a difference between financial accounting and managerial accounting.

We get asked by students about the difference between financial accounting and managerial accounting. The average business school student will be exposed to both financial accounting and managerial accounting concepts during their program. Often both financial accounting and managerial accounting may be taught in the same course and so many students are unclear about the difference between financial accounting and managerial accounting. Financial accounting and managerial accounting are definitely closely related and mix well but there is clearly a difference between financial accounting and managerial accounting.

Financial Accounting

Financial accounting is what most people think of when they envision the accountant at work. Financial accounting is concerned with the principles, practices and systems employed to compile transactions of an entity and present financial information for use by an entity’s internal and external stakeholders. An entity’s internal and external stakeholders include the entity’s employees, managers, owners, creditors, suppliers, customers and regulators. Presenting specified financial information in prescribed formats and under specified guidelines to stakeholders is a mandatory requirement of the law. The financial information that financial accounting captures is usually presented as financial statements to an entity’s internal and external stakeholders. These financial statements include:

- Explanatory notes to those financial statements that provide the reader with insight into the reported amounts.

Notably, all of these statements report the entity’s past activities. An independent entity generally audits financial accounting information, especially the information that a publicly-traded company reports, in order to provide the company’s external stakeholders with some assurance that the information is accurate.

The entity’s accountants prepare these statements in accordance with some form of generally accepted accounting principles (GAAP); these may be either country-specific (such as the United States GAAP or Japan GAAP) or International Financial Reporting Standards. An independent standard-setting organization generally creates and promulgates these standards; for example, the Financial Accounting Standards Board promulgates United States GAAP for for-profit entities while the Government Accounting Standards Board promulgates GAAP for not-for-profit entities and state and local governments and the Federal Accounting Standard Advisory Board promulgates GAAP for the Federal Government.

Topics Covered in Financial Accounting

A number of topics are covered when you study financial accounting. Depending on the level of the course a student is taking (introductory accounting, intermediate or advanced accounting, professional course, etc) these topics may be covered in more depth. Generally the topics covered include topics:

- Accounting Principles

- Bookkeeping Rules, Processes and Formats

- Understanding the Chart of Accounts

- Bank Reconciliation

- Financial Ratio Analysis

- Recognizing, Valuing and Presenting Asset Accounts

- Inventory Accounting

- Working Capital

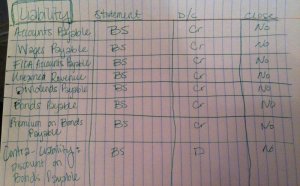

- Recognizing and Presenting Liabilities

- Equity Accounting

- Payroll Accounting

- Receivables & Bad Debts Accounting

- Revenue Recognition Principles

- Taxation

The topics covered in managerial accounting are quite different. However a student may need to understanding these topics to a limited extend to be able to really understand managerial accounting.

Professional Qualifications of a Financial Accountant

While a financial accountant need not be licensed or certified to perform most financial accounting roles, those holding a Certified Public Accountant (CPA) designation are generally considered to be experts at for-profit as well as not-for-profit and state and local government financial accounting and reporting standards. The American Institute of Certified Public Accountants develops the content for the Uniform CPA Examination and scores each examination. The Uniform CPA Examination tests a candidate’s knowledge of and skill in auditing and attestation standards and procedures, the businesses reasons for and accounting implications of various types of business transactions, generally accepted accounting principles, and federal taxation, professional ethics and business law. CPAs are licensed by states and each state imposes a unique set of education and experience requirements on candidates for licensure; however, it has become easier for CPAs to transfer their licenses between states as more states have adopted the Uniform Accountancy Act. CPAs meet strict ethical standard and are required to complete continuing education courses, including those in ethics, in order to renew their licenses to practice accounting.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting Final

FINAL REPORTING REQUIREMENTS FOR DISSERTATION FIELDWORK AND POST PH.D. RESEARCH GRANTS Upon conclusion of the research phase…

Read MoreAdvanced Financial Accounting.pdf

Advanced Financial Accounting, 10th Edition - Christensen

Read More