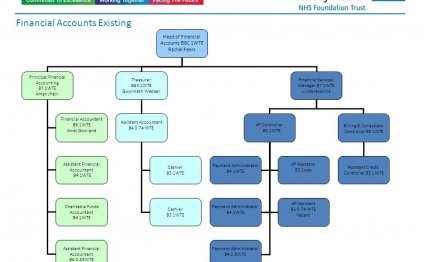

Assistant Financial Accountant

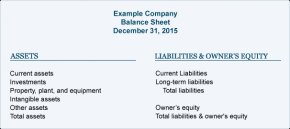

The accounting balance sheet is one of the major financial statements used by accountants and business owners. (The other major financial statements are the, , and ) The balance sheet is also referred to as the statement of financial position.

The balance sheet presents a company's financial position at the end of a specified date. Some describe the balance sheet as a "snapshot" of the company's financial position at a point (a moment or an instant) in time. For example, the amounts reported on a balance sheet dated December 31, 2015 reflect that instant when all the transactions through December 31 have been recorded.

Because the balance sheet informs the reader of a company's financial position as of one moment in time, it allows someone—like a creditor—to see what a company owns as well as what it owes to other parties as of the date indicated in the heading. This is valuable information to the banker who wants to determine whether or not a company qualifies for additional credit or loans. Others who would be interested in the balance sheet include current investors, potential investors, company management, suppliers, some customers, competitors, government agencies, and labor unions.

In Part 1 we will explain the components of the balance sheet and in Part 2 we will present a sample balance sheet. If you are interested in balance sheet analysis, that is included in the .

We will begin our explanation of the accounting balance sheet with its major components, elements, or major categories:

- Assets

- Liabilities

- Owner's (Stockholders') Equity

In you will find some special materials on the balance sheet. For example, the video seminar Understanding Financial Statements provides a line-by-line explanation of a balance sheet. PRO also includes a visual tutorial, business forms, and exam questions that will help you learn and retain information on the balance sheet.

Assets

are things that the company owns. They are the resources of the company that have been acquired through transactions, and have future economic value that can be measured and expressed in dollars. Assets also include costs paid in advance that have not yet, such as prepaid advertising, prepaid insurance, prepaid legal fees, and prepaid rent. (For a discussion of prepaid expenses go to .)

Examples of asset accounts that are reported on a company's balance sheet include:

Usually asset accounts will have debit balances.

are asset accounts with credit balances. (A credit balance in an asset account is contrary—or contra—to an asset account's usual debit balance.) Examples of contra asset accounts include:

Classifications Of Assets On The Balance Sheet

Accountants usually prepare . "Classified" means that the balance sheet accounts are presented in distinct groupings, categories, or classifications. The asset classifications and their order of appearance on the balance sheet are:

An outline of a balance sheet using the balance sheet classifications is shown here:

To see how various asset accounts are placed within these classifications.

Effect of Cost Principle and Monetary Unit Assumption

The amounts reported in the asset accounts and on the balance sheet reflect actual costs recorded at the time of a transaction. For example, let's say a company acquires 40 acres of land in the year 1950 at a cost of $20, 000. Then, in 1990, it pays $400, 000 for an adjacent 40-acre parcel. The company's account will show a balance of $420, 000 ($20, 000 for the first parcel plus $400, 000 for the second parcel.). This account balance of $420, 000 will appear on today's balance sheet even though these parcels of land have appreciated to a current market value of $3, 000, 000.

There are two guidelines that oblige the accountant to report $420, 000 on the balance sheet rather than the current market value of $3, 000, 000: (1) the directs the accountant to report the company's assets at their original historical cost, and (2) the directs the accountant to presume the U.S. dollar is stable over time—it is not affected by inflation or deflation. In effect, the accountant is assuming that a 1950 dollar, a 1990 dollar, and a 2015 dollar all have the same purchasing power.

The cost principle and monetary unit assumption may also mean that some very valuable resources will not be reported on the balance sheet. A company's team of brilliant scientists will not be listed as an asset on the company's balance sheet, because (a) the company did not purchase the team in a transaction (cost principle) and (b) it's impossible for accountants to know how to put a dollar value on the team (monetary unit assumption).

Coca-Cola's logo, Nike's logo, and the trade names for most consumer products companies are likely to be their most valuable assets. If those names and logos were developed internally, it is reasonable that they will not appear on the company balance sheet. If, however, a company should purchase a product name and logo from another company, that cost will appear as an asset on the balance sheet of the acquiring company.

Remember, accounting principles and guidelines place some limitations on what is reported as an asset on the company's balance sheet.

Effect of Conservatism

While the cost principle and monetary unit assumption generally prevent assets from being reported on the balance sheet at an amount greater than cost, conservatism will result in some assets being reported at less than cost. For example, assume the cost of a company's inventory was $30, 000, but now the current cost of the same items in inventory has dropped to $27, 000. The conservatism guideline instructs the company to report Inventory on its balance sheet at $27, 000. The $3, 000 difference is reported immediately as a loss on the company's income statement.

Effect of Matching Principle

The matching principle will also cause certain assets to be reported on the accounting balance sheet at less than cost. For example, if a company has Accounts Receivable of $50, 000 but anticipates that it will collect only $48, 500 due to some customers' financial problems, the company will report a credit balance of $1, 500 in the contra asset account Allowance for Doubtful Accounts. The combination of the asset Accounts Receivable with a debit balance of $50, 000 and the contra asset Allowance for Doubtful Accounts with a credit balance will mean that the balance sheet will report the net amount of $48, 500. The income statement will report the $1, 500 adjustment as Bad Debts Expense.

The matching principle also requires that the cost of buildings and equipment be depreciated over their useful lives. This means that over time the cost of these assets will be moved from the balance sheet to Depreciation Expense on the income statement. As time goes on, the amounts reported on the balance sheet for these long-term assets will be reduced. (For a further discussion on depreciation, go to .)

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Salary of Financial Accountant

Financial accountability is pivotal to maintaining a healthy business, and financial accountants conduct a number of functions…

Read MoreGroup Financial Accountant

Financial Accountant OnApp Ltd - London E1 £45, a year An exciting venture backed software company in Tech City, London…

Read More