Management Accounting and Financial Accounting

Accounting, according to an article from Quick MBA, serves to provide essential information so business professionals can make good economic decisions. In a business, two types of accounting reports are prepared-management and financial-and both are essential in their own way.

Accounting, according to an article from Quick MBA, serves to provide essential information so business professionals can make good economic decisions. In a business, two types of accounting reports are prepared-management and financial-and both are essential in their own way.

Identification

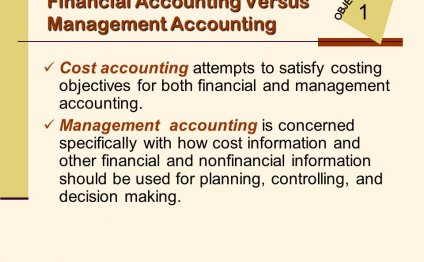

Management, or managerial, accounting is used to run companies and help managers make important financial decisions. Accountants prepare these documents and send them directly to personnel within a company, such as managers and executives. These reports break down numbers and projections related to departments, products, employees and customers and how they affect the company. Financial accounting reports are prepared by accountants and sent directly to entities outside of the company, such as stockholders, tax professionals and lenders. These reports show concrete numbers, as well as past mistakes and achievements. These documents are objective, factual and avoid projections.

Benefits

Management and financial accounting reports, while each used in different settings, provide their recipients with benefits that are unique to each format. Management accounting reports provide estimates for what might happen in the future. A manager needs projections and would rather use estimates on what will happen than reports on what has already happened because of the ever-changing financial terrain in business. This type of accounting often benefits the future of a company. Investors and tax professionals need hard facts based on numbers that already exist, so they can properly assess a company's performance. Financial accounting reports provide the precision these professionals need to gauge the solidity of a company.

Related Reading: The Differences Between Financial Accounting & Management Accounting

Principles

Because financial accounting reports are for objective outside sources, they must abide by the generally accepted accounting principles (GAAP), according to Accounting for Management. This means that reports must be delivered in accordance with set ground rules to remain consistent and concrete every time. For example, the GAAP requires a piece of land be assessed at its cost in the past (its historical cost), while if a company is thinking about purchasing a plot of land, management will want to see the current value of the land, along with projections for future value.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

International Financial Accounting and Reporting

There are many accounting standards in the world, with each country using a version of their own generally accepted accounting…

Read MoreFinancial and Accounting software

Intacct’s online accounting software is built on a multi-dimensional general ledger, giving you visibility into your whole…

Read More