Financial Accounting income Statement example

The multiple-step profit and loss statement segregates the operating revenues and operating expenses from the nonoperating revenues, nonoperating expenses, gains, and losses. The multiple-step income statement also shows the gross profit (net sales minus the cost of goods sold).

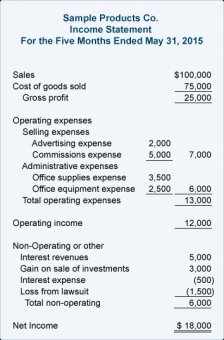

Here is a sample income statement in the multiple-step format:

Using the above multiple-step income statement as an example, we see that there are three steps needed to arrive at the bottom line Net Income:

Step 1.Cost of goods sold is subtracted from net sales to arrive at the gross profit. Step 2.

Operating expenses are subtracted from gross profit to arrive at operating income. Step 3.

The net amount of nonoperating revenues, gains, nonoperating expenses and losses is combined with the operating income to arrive at the net income or net loss.

There are three benefits to using a multiple-step income statement instead of a single-step income statement:

- The multiple-step income statement clearly states the gross profit amount. Many readers of financial statements monitor a company's (gross profit as a percentage of net sales). Readers may compare a company's gross margin to its past gross margins and to the gross margins of the industry.

- The multiple-step income statement presents the subtotal, which indicates the profit earned from the company's primary activities of buying and selling merchandise.

- The bottom line of a multiple-step income statement reports the net amount for all the items on the income statement. If the net amount is positive, it is labeled as . If the net amount is negative, it is labeled as .

https://www.norwich-terrier.top puppies amblegreen norwich terriers puppies.

Share this Post

Related posts

Financial Accounting Cheat sheet

Accounting is a system used in maintaining financial records for all types of businesses, organizations and institutions…

Read MoreFinancial Accounting by Libby Libby and Short

Financial Accounting, 8/e Robert Libby, Cornell University - Ithaca Patricia A. Libby, Ithaca College Daniel G. Short, Texas…

Read More