Audit Program Accounts Receivable

If your company is subject to an annual audit, the auditors will review its accounts receivable in some detail. Accounts receivable is frequently the largest asset that a company has, so auditors tend to spend a considerable amount of time gaining assurance that the amount of the stated asset is reasonable.

Here are some of the accounts receivable audit procedures that they may follow:

- Trace receivable report to general ledger. The auditors will ask for a period-end accounts receivable aging report, from which they trace the grand total to the amount in the accounts receivable account in the general ledger. (If these totals do not match, you may have a journal entry somewhere in the general ledger account that should not be there)

- Calculate the receivable report total. The auditors will add up the invoices on the accounts receivable aging report to verify that the total they traced to the general ledger is correct.

- Investigate reconciling items. If you have journal entries in the accounts receivable account in the general ledger, the auditors will likely want to review the justification for the larger amounts. This means that these journal entries should be fully documented.

- Test invoices listed in receivable report. The auditors will select some invoices from the accounts receivable aging report and compare them to supporting documentation to see if they were billed in the correct amounts, to the correct customers, and on the correct dates.

- Match invoices to shipping log. The auditors will match invoice dates to the shipment dates for those items in the shipping log, to see if sales are being recorded in the correct accounting period. This can include an examination of invoices issued after the period being audited, to see if they should have been included in a prior period.

- Confirm accounts receivable. A major auditor activity is to contact your customers directly and ask them to confirm the amounts of unpaid accounts receivable as of the end of the reporting period they are auditing. This is primarily for larger account balances, but may include a few random customers having smaller outstanding invoices.

- Review cash receipts. If the auditors are unable to confirm accounts receivable, their backup auditing technique is to verify that customers have paid the invoices, for which they will want to review checks copies and trace them through your bank account.

- Assess the allowance for doubtful accounts. The auditors will review the process that you follow to derive an allowance for doubtful accounts. This will include a consistency comparison with the method you used in the last year, and a determination of whether the method is appropriate for your business environment.

- Assess bad debt write-offs. The auditors will compare the proportion of bad debt expense to sales for this year in comparison to prior years, to see if the current expense appears reasonable.

- Review credit memos. The auditors will review a selection of the credit memos issued during the audit period to see if they were properly authorized, whether they were issued in the correct period, and whether the circumstances of their issuance may indicate other problems. They may also review credit memos issued after the period being audited, to see if they relate to transactions from within the audit period.

- Assess bill and hold sales. If you have situations where you are billing customers for sales despite still retaining the goods on-site (known as "bill and hold"), the auditors will examine your supporting documentation to determine whether a sale has actually taken place.

- Review receiving log. The auditors will review the receiving log to see if it records an inordinately large amount of customer returns after the audit period, which would suggest that the company may have shipped more goods near the end of the audit period than customers had authorized.

- Related party receivables. If there are any related party receivables, the auditors may review them for collectibility, as well as whether they should instead be recorded as wages or dividends, and whether they were properly authorized.

- Trend analysis. The auditors may review a trend line of sales and accounts receivable, or a comparison of the two over time, to see if there are any unusual trends. Another possible comparison is of receivables to current assets. They may also measure the average collection period. If so, expect them to make inquiries about the reasons for changes in the trends.

The preceding list of audit procedures is designed to detect a variety of audit risks, which include the following:

- That receivables do not exist

- That recorded receivable balances are inaccurate

- That it may not be possible to collect accounts receivable

- That the derivation of the allowance for doubtful accounts may not properly reflect bad debt experience

- That sales transactions were not processed in the correct periods

- That revenue was incorrectly recognized

YOU MIGHT ALSO LIKE

Auditing 7: Receivables, Payables

Audit Program: Receivables

Share this Post

Related posts

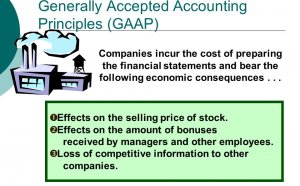

Principles of Financial Accounting McGraw Hill

FEBRUARY 19, 2025

Principles of Financial Accouting John J. Wild, University of Wisconsin-Madison Ken W. Shaw, University of Missouri-Columbia…

Read MoreRelevance in Financial Accounting

FEBRUARY 19, 2025

In accounting, the term relevance means it will make a difference to a decision maker. For example, in the decision to replace…

Read More