Forensic Accounting VS Auditing

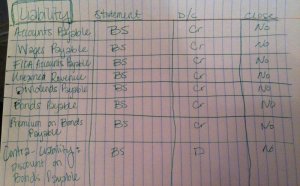

Forensic accountants and auditors must understand basic accounting concepts.

Forensic accountants and auditors must understand basic accounting concepts.

Images

The field of accounting operates with many specializations, and auditing and forensic accounting are two of the most common. Although forensic accounting analysis and auditing seem like similar specialties, significant differences exist within the two job functions. Forensic accountants search specifically for fraudulent activity within organizations; auditors verify that companies are compliant with federal regulations and organizational policies. Companies in need of accounting assistance should understand the difference between the two specialities.

Forensic Accounting Job Duties

According to Peter Vogt of Young Money, fraud and other white-collar crimes cost companies billions of the dollars a year. In an effort to uncover and prevent fraudulent activity and theft, companies employ forensic accountants. Forensic accounting analysis consists of analyzing financial documents to search for illegal activity within an organization, specifically white-collar crime. Forensic analysis is comprised of litigation support, investigation and dispute resolution. Some of the criminal activities that forensic accountants look for include fraud, money laundering and embezzlement. If a person within an organization is convicted of a crime, the forensic accountant responsible for finding the illegal may need to testify in court.

Forensic Accounting Career Qualifications

Forensic accountants typically possess at least a bachelor's degree in accounting or a related field. Analytical and communication skills are very important to succeed as a forensic accountant. Individuals must understand corporate laws and regulations surrounding the accounting industry. Many employers desire to hire individuals who possess the certified fraud examiner designation. To meet certification qualifications, candidates must possess at least a bachelor's degree in any field or two years of fraud-related work experience. Candidates must pass a four-part, 500 multiple choice question exam administered by the Association of Certified Fraud Examiners.

Related Reading: Cash Vs. Accrual for Large Companies

Auditing Job Duties

Auditing is divided into two primary specializations - public auditing and internal auditing. Public auditors work for accounting companies that are hired to audit the financial records of public and private companies. The Securities and Exchange Commission (SEC) requires all public companies undergo an audit from a CPA designated accounting firm or individual. Public auditors file reports with the SEC regarding the results of the audit. Internal auditors work for private and public companies and are responsible for analyzing the organization's internal controls to prevent fraud. External and internal auditors may analyze a company's products, services, operations and processes. Auditors do not analyze every financial record of a company but rather a sample size.

Share this Post

Related posts

Forensic Accounting and Auditing

Forensic accountants, investigative accountants or expert accountants may be involved in recovering proceeds of crime and…

Read MoreFinancial Accounting Final

FINAL REPORTING REQUIREMENTS FOR DISSERTATION FIELDWORK AND POST PH.D. RESEARCH GRANTS Upon conclusion of the research phase…

Read More