Accounting for Financial instruments and derivatives

FAS 133

(Financial Accounting Standards Board Statement No. 133, Accounting for Derivative Instruments and Hedging Activities)

Summary

This Statement establishes accounting and reporting standards for derivative instruments, including certain derivative instruments embedded in other contracts, (collectively referred to as derivatives) and for hedging activities. It requires that an entity recognize all derivatives as either assets or liabilities in the statement of financial position and measure those instruments at fair value. If certain conditions are met, a derivative may be specifically designated as (a) a hedge of the exposure to changes in the fair value of a recognized asset or liability or an unrecognized firm commitment, (b) a hedge of the exposure to variable cash flows of a forecasted transaction, or (c) a hedge of the foreign currency exposure of a net investment in a foreign operation, an unrecognized firm commitment, an available-for-sale security, or a foreign-currency-denominated forecasted transaction.The accounting for changes in the fair value of a derivative (that is, gains and losses) depends on the intended use of the derivative and the resulting designation.

- For a derivative designated as hedging the exposure to changes in the fair value of a recognized asset or liability or a firm commitment (referred to as a fair value hedge), the gain or loss is recognized in earnings in the period of change together with the offsetting loss or gain on the hedged item attributable to the risk being hedged. The effect of that accounting is to reflect in earnings the extent to which the hedge is not effective in achieving offsetting changes in fair value.

- For a derivative designated as hedging the exposure to variable cash flows of a forecasted transaction (referred to as a cash flow hedge), the effective portion of the derivatives gain or loss is initially reported as a component of other comprehensive income (outside earnings) and subsequently reclassified into earnings when the forecasted transaction affects earnings. The ineffective portion of the gain or loss is reported in earnings immediately.

- For a derivative designated as hedging the foreign currency exposure of a net investment in a foreign operation, the gain or loss is reported in other comprehensive income (outside earnings) as part of the cumulative translation adjustment. The accounting for a fair value hedge described above applies to a derivative designated as a hedge of the foreign currency exposure of an unrecognized firm commitment or an available-for-sale security. Similarly, the accounting for a cash flow hedge described above applies to a derivative designated as a hedge of the foreign currency exposure of a foreign-currency-denominated forecasted transaction.

- For a derivative not designated as a hedging instrument, the gain or loss is recognized in earnings in the period of change.

Under this Statement, an entity that elects to apply hedge accounting is required to establish at the inception of the hedge the method it will use for assessing the effectiveness of the hedging derivative and the measurement approach for determining the ineffective aspect of the hedge. Those methods must be consistent with the entitys approach to managing risk.

This Statement applies to all entities. A not-for-profit organization should recognize the change in fair value of all derivatives as a change in net assets in the period of change. In a fair value hedge, the changes in the fair value of the hedged item attributable to the risk being hedged also are recognized. However, because of the format of their statement of financial performance, not-for-profit organizations are not permitted special hedge accounting for derivatives used to hedge forecasted transactions. This Statement does not address how a not-for-profit organization should determine the components of an operating measure if one is presented.

This Statement precludes designating a nonderivative financial instrument as a hedge of an asset, liability, unrecognized firm commitment, or forecasted transaction except that a nonderivative instrument denominated in a foreign currency may be designated as a hedge of the foreign currency exposure of an unrecognized firm commitment denominated in a foreign currency or a net investment in a foreign operation.

This Statement amends FASB Statement No. 52, Foreign Currency Translation, to permit special accounting for a hedge of a foreign currency forecasted transaction with a derivative. It supersedes FASB Statements No. 80, Accounting for Futures Contracts, No. 105, Disclosure of Information about Financial Instruments with Off-Balance-Sheet Risk and Financial Instruments with Concentrations of Credit Risk, and No. 119, Disclosure about Derivative Financial Instruments and Fair Value of Financial Instruments. It amends FASB Statement No. 107, Disclosures about Fair Value of Financial Instruments, to include in Statement 107 the disclosure provisions about concentrations of credit risk from Statement 105. This Statement also nullifies or modifies the consensuses reached in a number of issues addressed by the Emerging Issues Task Force.

A Critical View (from FAS133.com)

What is FAS 133?

Statement 133 (FAS 133 or SFAS 133) establishes accounting and reporting standards for derivative instruments, including certain derivative instruments embedded in other contracts and for hedging activities. Released in June 1998, FAS 133 represents the culmination of the US Financial Accounting Standards Board's nearly decade-long effort to develop a comprehensive framework for derivatives and hedge accounting. The Financial Accounting Standards Board establishes generally accepted accounting principles for most companies operating in the United States or requiring financial statements meeting US GAAP (see FASB site for more).

Simplicity is not one of FAS 133s strong suits. Thats partly because FAS 133 is a halfway house of sorts, falling short of full fair value accounting (the FASBs ultimate goal) and maintaining some old accounting that dates back to FAS 52. This complexity is largely the reason the FASB has set up a special committee to deliberate and explain how to apply FAS 133. This committee is known as the Derivatives Implementation Group (DIG). Despite the special efforts of the DIG, the FASB was forced to delay implementation for one year. And now, working with the DIG, the FASB is considering amendments that change significantly the impact on certain accounting aspects.

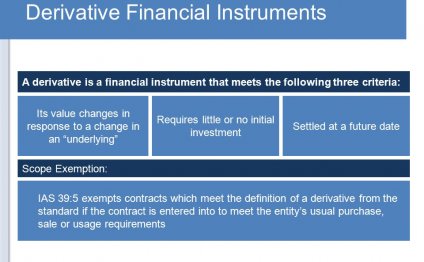

A careful reading of the Statement, put within the context of its founding fathers original intent, helps us collapse the lengthy document into key concepts:(1) FAS 133 focuses on the hedge tools and not the sort of risk thats being hedged.This is a fundamental change in hedge accounting. Instead of focusing on currency (FAS 52) or commodities (FAS 80), FAS 133 occupies itself with derivatives, no matter how they are used. The good news? If its not a derivative, its not scoped in. The bad news? The definition of a derivative is pretty wide and include several commercial contracts as well.

(2) FAS 133 is a compromise on fair value accounting. FAS 133 puts an end to deferral accounting as we know it. Ultimately, the Board would like to have all financial instruments on the balance sheet at fair value. Such a radical overhaul particularly for non-bankswould have created massive income statement effects. So instead, the Board compromised, offering hedgers (vs. traders of derivatives) a halfway house in the form of Other Comprehensive Income (OCI). OCI is a place to park gains and losses on hedges until it is time to recognized them in current income. Its part of the income statement, but not current earnings. This compromise solution, inevitably, creates inconsistency in the treatment of certain gains and losses.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting for Manager

Financial accounting manager positions are available in a wide range of organizations, including companies that focus specifically…

Read MoreAccounting for Financial Services

Associated Students (A.S.) Accounting and Financial Services provides many amenities to all CSUN students, especially when…

Read More