Auditing Accounting estimates

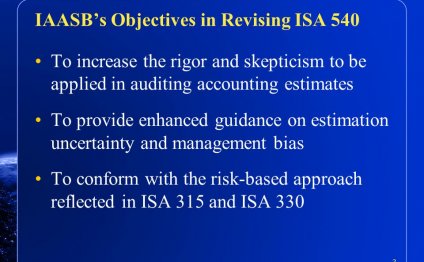

AU-C Section 540, Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures, did not change or expand previous auditing standards in any significant respect. This section is restructured to reflect a more principles-based approach to standard-setting.

As has been done in other clarified auditing standards, certain requirements that are duplicative of broader requirements have been moved to application and other explanatory material. This section combines previous AU Section 342, Auditing Accounting Estimates, with previous AU Section 328, Auditing Fair Value Measurements and Disclosures (AICPA, Professional Standards, Vol. 1).

The following are some important definitions from AU-C Section 540 affecting risk assessment procedures for accounting estimates, including fair value estimates.

Accounting estimate. This is an approximation of a monetary amount in the absence of a precise measurement. This term applies for fair value and other estimates when there is estimation uncertainty.

Auditor’s point estimate or auditor’s range. This is the amount or a range obtained from audit evidence used to evaluate relevant financial statement assertions in recorded amounts.

Estimation uncertainty. The susceptibility of an accounting estimate and related disclosures to the likelihood of misstatement or the lack of precision in their calculation or determination.

Management bias. Management’s lack of unbiased objectivity in the preparation and fair presentation of financial information.

Management’s point estimate. Management’s determination of amounts for recognition or disclosure as accounting estimates.

All the definitions above will be affected by the requirements of various financial reporting frameworks.

Risk Assessment Procedures and Related Activities

As part of an auditor obtaining an understanding of the entity and its environment, including internal control, as required by AU-C Section 315, Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement, the auditor should perform the following in assessing the risks of material misstatement for accounting estimates:

- The requirements of the applicable financial reporting framework relevant to accounting estimates, including related disclosures.

- How management identifies those transactions, events, and conditions that may give rise to the need for accounting estimates to be recognized or disclosed in the financial statements.

- How management makes the accounting estimates and the data on which they are based, including the methods and assumptions in making the accounting estimate, any applicable relevant controls for making the estimate and whether a specialist was involved, any changes made – or which should have been made – from the prior period’s methods and assumptions, and management’s assessment of any effects of estimation uncertainty.

An Application Example for Fixed Assets

The principal issues in AU-C Section 540 affecting fixed assets would be connected with the valuation of assets received in nonmonetary exchanges and with the calculation of the fair values of future cash flows of an asset to determine if it is recoverable or if its fair value is less than its carrying amount.

The auditor must evaluate the reasonableness of management’s calculation of fair values or, if management can’t or doesn’t make such calculations, request the client hire a specialist or request a client employee with suitable skill, knowledge, or experience be assigned to oversee the valuation process performed by the auditor (for nongovernmental, nonpublic audits only). Any other fair value accounting processes applied to fixed assets would also require the auditor’s review of management’s process and the results of the application.

Other principal issues for fixed assets relate to the useful lives and residual values of depreciable assets and their depreciation and amortization methods. The auditor must determine that these estimates are reasonable and appropriate in the client’s circumstances.

More Information

These eBook resources, without CPE credit, can be obtained from my website:

- Small Audits Made Easy and Profitable

- Performing Auditing Tests of Balances Procedures

- Staff Training Series for Entry-Level Accountants, New In-Charge Accountants and Engagement Leaders

- Key Accounting Issues for Non-Profit Organizations

- A Practical Potpourri of Time Savings on Audits

- The Financial Reporting Framework for Small- and Medium-Sized Entities

My exclusive presentation of webcasts on CPEcredit.com and self-study courses covering various applications of auditing standards can be accessed by clicking the appropriate box on the left side of my home page, Registered users on my website receive a 20 percent discount on CPE materials presented by myself and numerous other authors on a variety of professional topics.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Accounting Auditing firms

Audit & accounting services assure your company’s compliance with requirements of applicable laws, financial reporting…

Read MoreAccounting Auditing & Accountability Journal

Current editor(s): James Guthrie and Lee Parker From Emerald Group Publishing Series data maintained by Louise Lister. Access…

Read More