Financial Accounting definition PDF

In financial accounting, a liability is defined as the future sacrifices of economic benefits that the entity is obliged to make to other entities as a result of past transactions or other past events, the settlement of which may result in the transfer or use of assets, provision of services or other yielding of economic benefits in the future.

A liability is defined by the following characteristics:

- Any type of borrowing from persons or banks for improving a business or personal income that is payable during short or long time;

- A duty or responsibility to others that entails settlement by future transfer or use of assets, provision of services, or other transaction yielding an economic benefit, at a specified or determinable date, on occurrence of a specified event, or on demand;

- A duty or responsibility that obligates the entity to another, leaving it little or no discretion to avoid settlement; and,

- A transaction or event obligating the entity that has already occurred.

Liabilities in financial accounting need not be legally enforceable; but can be based on equitable obligations or constructive obligations. An equitable obligation is a duty based on ethical or moral considerations. A constructive obligation is an obligation that is implied by a set of circumstances in a particular situation, as opposed to a contractually based obligation.

The accounting equation relates assets, liabilities, and owner's equity:

A liability is a present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow from the enterprise of resources embodying economic benefits

— F.49(b)

Regulations as to the recognition of liabilities are different all over the world, but are roughly similar to those of the IASB.

Liabilities are debts and obligations of the business they represent as creditor's claim on business assets.

Examples[edit]

- Notes Payable

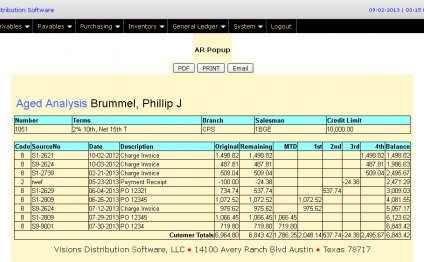

- Accounts Payable

- Salaries Payable

- Wages Payable

- Interest Payable

- Other Accrued Expenses Payable

- Income Taxes Payable

- Customer Deposits

- Warranty Liability

- Lawsuits Payable

- Unearned Revenues

- Bonds Payable

- Pensions Payable

Classification[edit]

- Current liabilities — these liabilities are reasonably expected to be liquidated within a year. They usually include payables such as wages, accounts, taxes, and accounts payable, unearned revenue when adjusting entries, portions of long-term bonds to be paid this year, short-term obligations (e.g. from purchase of equipment).

- Long-term liabilities — these liabilities are reasonably expected not to be liquidated within a year. They usually include issued long-term bonds, notes payables, long-term leases, pension obligations, and long-term product warranties.

Liabilities of uncertain value or timing are called provisions.

Example[edit]

Money deposited with a bank becomes a liability of the bank, because the bank has an obligation to pay the depositor the money deposited; usually on demand. The money deposited is an asset for the depositor. (The bank will record an ASSET when money is deposited, and their double-entry accounting correspondingly records an equal LIABILITY since the bank doesn't own the ASSET.)

A debit increases an asset; and a credit decreases an asset. A debit decreases a liability; and credit increases a liability.

When a bank receives a deposit it credits a liability account called "deposits" and debits the depositor's bank account for the same amount (the bank's "deposits" account is the sum of all of the amounts credited to all of its customer's individual bank accounts). A deposit received by a bank is credited because the bank's liability to its customer, the depositor, increases. When a bank informs its depositor that it has debited the depositor's bank account, it means that the depositor's bank account has been increased by the amount debited.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting Definitions

Financial accounting is a system that accumulates, processes and reports information about an entity s performance (i.e…

Read MoreFinancial Accounting notes PDF

Ireland fully supports the global move towards Automatic Exchange of Information (AEOI) for tax purposes and is actively…

Read More