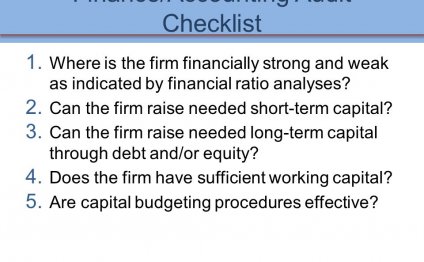

Accounting Audit Checklist

Auditors use checklist to ensure efficiency.

Auditors use checklist to ensure efficiency.

Stockbyte/Stockbyte/Getty Images

An audit engagement is a critical exercise for stakeholders such as employees, owners, investors and lenders. For the sake of efficiency, auditors must focus on standard audit tasks; they can't focus on every quirk the audited company displays. Doing so can cost the auditor his time and may result in unnecessary expenses for the company. Auditors can make the audit engagement more efficient and complete if they use audit checklists.

Significance

Auditing is a hectic exercise because auditors must gather and document evidence for every function of the organization that is subject to audit. For example, they'll need to inspect every document and every aspect of the balance sheet. Checklists are control documents that help auditors identifying procedures that they need to perform. They also can be used as quick references to identify whether a company complies with a regulation or meets the criteria for a control. Before auditors finalize the audit report, they consult these checklists, and If items were missed or the company's processes did not meet the required controls, they can be addressed.

Financial Statement Checklist

The entire balance sheet is audited against generally accepted accounting practices. These practices outline the criteria for dealing with transactions and the amounts that must be presented in the financial statements. Financial statement checklists help auditor reassess if they overlooked GAAP requirements, which are extensive and can change at any time. Organizations such as the American Institute of CPAs prepare checklists that detail the procedures that the auditor should perform. These checklists often include applicable reporting requirements and GAAP disclosure guidance. From the audited company's viewpoint, the financial statement checklist might include a list of items that auditors typically request.

Related Reading: Roles & Responsibilities of External Audit Firms

Compliance Checklists

Auditors also inspect companies for legal and regulatory compliance. This is done at the same time when auditors check for accounting practices and treatments. The company may be required to observe compliance pertaining to stock market listing, environmental protection or employee compensations. For example, the U.S. Securities and Exchange Commission requires sets out requirements for financial statements that must be filed in Regulation S-X. Auditors can develop checklists and confirm that they have performed all the procedures that cover the disclosure requirements the SEC outlines in this regulation.

Quality Review Checklist

Audit firms are also reviewed for the quality of the work they do. It is for these purposes that auditors maintain internal quality review checklists. This list outlines the procedures and steps that auditors need to take to make sure that they conduct objective audits. Some items in the checklist might be extremely basic. For example, the list might ask if the audit report is in writing and if the word “independent” is included in the title. Although basic, these items are required audit standards. The quality review checklist itemizes all processes that the auditor should have performed and gives an opportunity for the auditor to explain processes that were not performed.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Accounting Audit process

Steps Method 1 Preparing To Perform a Basic Financial Audit Understand financial audits. Quite simply, financial audits exist…

Read MoreAccounting Auditing firms

Audit & accounting services assure your company’s compliance with requirements of applicable laws, financial reporting…

Read More