Financial Accounting Accounts Receivable

Introduction to Accounts Receivable and Bad Debts Expense

If we imagine buying something, such as groceries, it's easy to picture ourselves standing at the checkout, writing out a personal check, and taking possession of the goods. It's a simple transaction—we exchange our money for the store's groceries.

In the world of business, however, many companies must be willing to sell their goods (or services) on credit. This would be equivalent to the grocer transferring ownership of the groceries to you, issuing a sales invoice, and allowing you to pay for the groceries at a later date.

Whenever a seller decides to offer its goods or services on credit, two things happen: (1) the seller boosts its potential to increase revenues since many buyers appreciate the convenience and efficiency of making purchases on credit, and (2) the seller opens itself up to potential losses if its customers do not pay the sales invoice amount when it becomes due.

Under the accrual basis of accounting (which we will be using throughout our discussion) a sale on credit will:

- Increase sales or sales revenues, which are reported on the income statement, and

- Increase the amount due from customers, which is reported as accounts receivable—an asset reported on the balance sheet.

If a buyer does not pay the amount it owes, the seller will report:

- A credit loss or bad debts expense on its income statement, and

- A reduction of accounts receivable on its balance sheet.

With respect to financial statements, the seller should report its estimated credit losses as soon as possible using the allowance method. For income tax purposes, however, losses are reported at a later date through the use of the direct write-off method.

Recording Services Provided on Credit

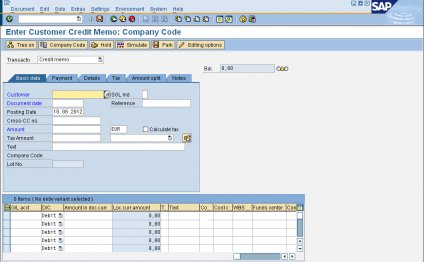

Assume that on June 3, Malloy Design Co. provides $4, 000 of graphic design service to one of its clients with credit terms of net 30 days. (Providing services with credit terms is also referred to as providing services on account.)

Under the accrual basis of accounting, revenues are considered earned at the time when the services are provided. This means that on June 3 Malloy will record the revenues it earned, even though Malloy will not receive the $4, 000 until July. Below are the accounts affected on June 3, the day the service transaction was completed:

In this transaction, the debit to Accounts Receivable increases Malloy's current assets, total assets, working capital, and stockholders' (or owner's) equity—all of which are reported on its balance sheet. The credit to Service Revenues will increase Malloy's revenues and net income—both of which are reported on its income statement.

https://phonetech.ee bare overfyldt distrahere ministerium so iduki aku vahetus.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting access code

Guided Examples provide narrated and animated, step-by-step walkthroughs of algorithmic versions of assigned exercises. This…

Read MoreFinancial Accounting conventions

The most commonly encountered convention is the historical cost convention . This requires transactions to be recorded at…

Read More