Financial Accounting Course Outline

The aim of this course is to guide students in their acquisition of technical and problem solving skills in the area of corporate external financial reporting. Corporate external financial reporting comprises financial reporting by reporting entities to external stakeholders. It is mandatory for reporting entities to report in accordance with Australian accounting standards. Students in this course will gain skills in reading, interpreting and applying accounting standards. This course builds on introductory financial accounting. The course is essential for all individuals exposed to financial information in the workplace including accountants, auditors, financial analysts, managers, bankers and oversight bodies involved in the preparation or use of company financial statements. It would also be useful for those not wishing to become accountants but who plan to specialise in areas where accounting knowledge would be an advantage such as bankers and finance professionals, journalists, lawyers, and those interested in management positions including engineers and scientists.

Course Details

| Course Code | ACCTING 2501 |

|---|---|

| Course | Financial Accounting II |

| Coordinating Unit | Business School |

| Term | Semester 2 |

| Level | Undergraduate |

| Location/s | North Terrace Campus |

| Units | |

| Contact | Up to 4 hours per week |

| Available for Study Abroad and Exchange | |

| Prerequisites | ACCTING 1005 |

| Course Description | The aim of this course is to guide students in their acquisition of technical and problem solving skills in the area of corporate external financial reporting. Corporate external financial reporting comprises financial reporting by reporting entities to external stakeholders. It is mandatory for reporting entities to report in accordance with Australian accounting standards. Students in this course will gain skills in reading, interpreting and applying accounting standards. This course builds on introductory financial accounting. The course is essential for all individuals exposed to financial information in the workplace including accountants, auditors, financial analysts, managers, bankers and oversight bodies involved in the preparation or use of company financial statements. It would also be useful for those not wishing to become accountants but who plan to specialise in areas where accounting knowledge would be an advantage such as bankers and finance professionals, journalists, lawyers, and those interested in management positions including engineers and scientists. |

Course Timetable

Students must attend the lectures and workshop that they are enrolled in. Students will only be allowed to attend an alternative class under exceptional and unusual circumstances and with the permission of the course coordinator. Students who attend an alternative lecture or workshop without permission from the course coordinator will be required to leave.

Course Learning Outcomes

On completion of this course students should be able to:- Read and interpret Australian Accounting Standards.

- Understand, interpret and apply principles and regulations relating to financial accounting and the preparation of financial statements.

- Apply the processes of recognition, measurement and disclosure of accounting information in the preparation of general purpose financial statements.

- Read and comprehend journal articles written about accounting principles and practice.

- Critically analyse and interpret case information and be able to develop a convincing argument to present their views on relevant accounting issues.

- Work either individually or in a group to undertake research, solve problems and communicate their understanding of issues relating to the preparation of financial statements.

University Graduate Attributes

This course will provide students with an opportunity to develop the Graduate Attribute(s) specified below:

| University Graduate Attribute | Course Learning Outcome(s) |

|---|---|

| Deep discipline knowledge

|

1, 2, 3 |

Share this Post

Related posts

Financial Accounting conventions

The most commonly encountered convention is the historical cost convention . This requires transactions to be recorded at…

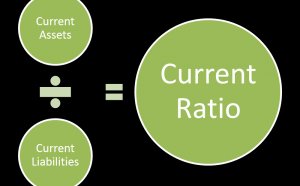

Read MoreFinancial Accounting current ratio

The current ratio is a financial ratio that shows the proportion of current assets to current liabilities. The current ratio…

Read More