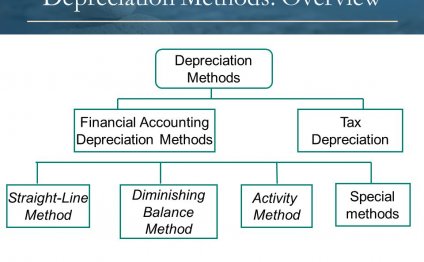

Financial Accounting depreciation methods

Topic Contents:

Types of depreciation

Common methods of depreciation are as follows:

Impact of using different depreciation methods

The total amount of depreciation charged over an asset's entire useful life (i.e. depreciable amount) is the same irrespective of the choice of depreciation method. The adoption of a particular depreciation method does however effect the amount of depreciation expense charged in each year of an asset's life.

Following diagram illustrates the effect of using different depreciation methods on yearly depreciation expense:

The above illustration is based on the following information:

Cost of fixed assetalign="center"x">Comparison of Depreciation Methods

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting definition PDF

In financial accounting, a liability is defined as the future sacrifices of economic benefits that the entity is obliged…

Read MoreFinancial Accounting practice questions

Thank you for taking our Financial Accounting and Reporting (FAR) review quiz. Check back again for five new sample FAR CPA…

Read More

Depreciation charge is reduced by 40% in each period (i.e. the rate used in this example) until the last year in which the entire un-depreciated amount is charged off.

Depreciation charge is reduced by 40% in each period (i.e. the rate used in this example) until the last year in which the entire un-depreciated amount is charged off.