Construction Accounting & Financial Management

CFMA’s Basics of Constructing Accounting is now new and improved, featuring up-to-date information, a user-friendly design, and many added benefits! The Basics of Construction Accounting Workshop is designed for accounting professionals new to the construction industry as well as non-accounting construction industry professionals who want or need a better understanding of construction accounting processes, construction cost management systems, job costs and job cost reporting, the WIP, and the most important elements of a contractor's financial statements. This one-day class presents an introduction to the key processes that make construction accounting unique.

Prerequisites:

This is a chapter classroom course at the Basic level. No prerequisites or advance preparation required.

Upon completing this one-day workshop, you will be able to:

- Identify key construction accounting principles.

- Explain the core points of revenue recognition.

- Discuss the importance of a job cost system.

- Calculate earned revenue.

- Identify what a construction company expects from its financial manager.

- Use industry data to benchmark your company.

Here's what’s covered:

- Industry Overview – The who, what, when & why of the construction industry

- Terminology & Authoritative Resources – Where to get the answers & what those answers mean

- The Contract Life Cycle – What happens when during this cycle that drives our business

- Elements of Financial Statements – What are yours saying about your company?

- Job Cost Reporting – What it is, what it isn’t, how to allocate costs, how to structure reports

- Revenue Recognition – Contract value, percent complete, what drives the WIP, the effect of change orders

- Computing Earned Revenue – What it is & how to compute it

- Cost in Excess/Billing in Excess Analysis – The ABCs of CIE & BIE

- Financial Statement Preparation & Analysis – What to look – and look out – for

- Cost Reporting Analysis – Tying together all you’ve learned

- What’s Expected of YOU?

- Unique Policies & Practices

- Industry Benchmarks

- And more!

CPE Credit:

This is an 8-hour course which earns 8 CPE credits in the field of Accounting.

Who Should Take This Course?

Accountants and CPAs new to the construction industry; New Construction Financial Managers & Controllers; Accounting Dept. Support Staff; Project Managers, Construction Managers, Risk & IT Professionals, Financial Services Providers, Owners, and anyone who would benefit from an understanding of the fundamental construction accounting processes.

Here’s what you can expect:

“The Basics” Workshop begins with an overview of the construction industry, then moves from the contract life cycle to job costing issues to financial reporting concerns and beyond. The workshop uses a sample contractor, a variety of problems, and several exercises that enable participants to evaluate real-life situations. But, this is not purely a "textbook course." As a participant, you are encouraged to share your own perspectives and to trade “war stories” during the case studies and general discussion segments of the program. You’ll come away with a deeper and broader understanding of construction accounting and financial management.

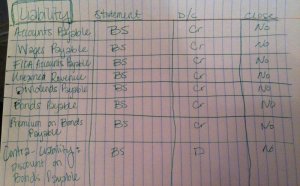

NOTE: If you are new to accounting or are completely unfamiliar with the fundamental elements of construction accounting, you may want to first enroll in CA101 Construction Accounting Concepts. This online, self-study course introduces debits and credits, journals and ledgers, the basics of job cost accounting and income recognition, financial statements, and other primary construction accounting concepts and processes. It is written for non-accountants. The second course in our online construction accounting series, CA102 Practical Accounting Application, provides an introduction to how the journal entries and transactions discussed in CA101 flow to the contractor’s financial statements. These online classes do not provide CPE credit.

Share this Post

Related posts

Financial Accounting Final

FINAL REPORTING REQUIREMENTS FOR DISSERTATION FIELDWORK AND POST PH.D. RESEARCH GRANTS Upon conclusion of the research phase…

Read MoreAdvanced Financial Accounting.pdf

Advanced Financial Accounting, 10th Edition - Christensen

Read More